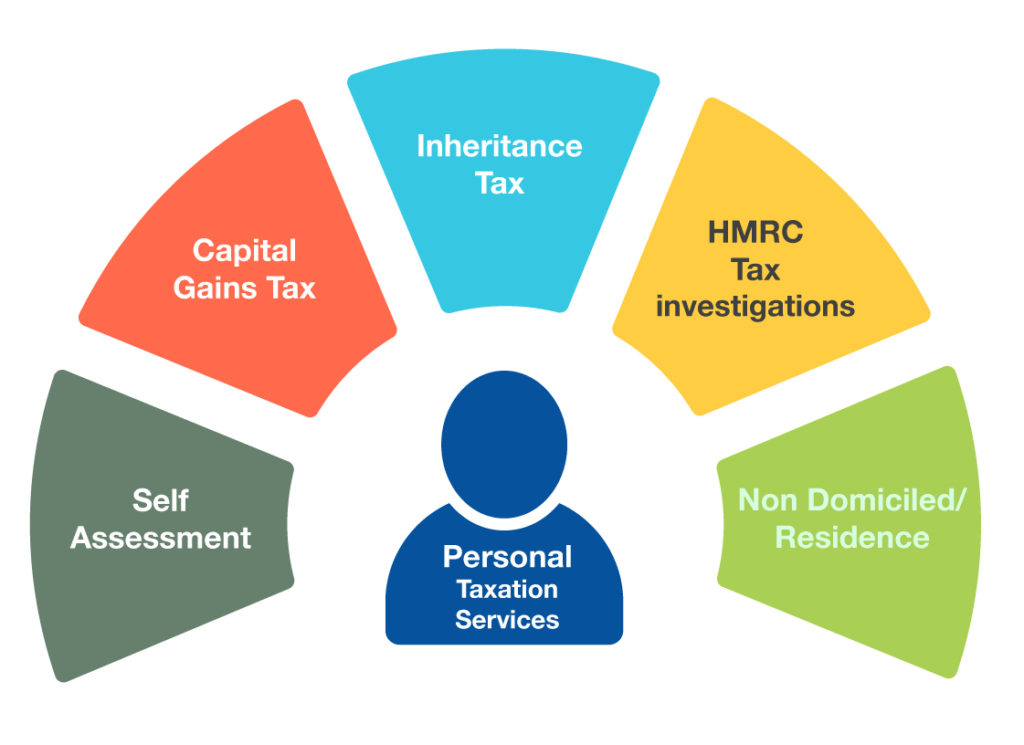

Private Client Services

Our personal taxation services are designed to help our clients:

1. to comply with HMRC requirements and

2. structure their tax affairs from cradle to grave in the most tax effective manner.

For in business it is not what you EARN that matters – it is what you get to KEEP that really counts.

We seek to provide our personal tax clients with a peace of mind irrespective of the source of their earnings: employment, savings, investments, partnership, self-employment, trusts, capital gain, inheritance or overseas. We apply our four steps approach:

1. Identify all relevant earnings, remuneration or asset valuation;

2. Identify all expenses incurred or allowable

3. Identify and apply the relevant allowances within our computation process;

4. Timely submission to HMRC of our client’s respective tax returns.